CREDIT TIPS

4 TIPS TO CONFIDENT CREDIT

- KNOW YOUR SCORE – Always know your FICO scores. We suggest checking your FICO score 2 times a year OR at least every 6 months. Be the FIRST to know what’s being reported about you. Check out our exclusive Identity IQ prices to get you started with knowing your FICO scores from all 3 bureaus (Equifax, Experian, TransUnion).

- BE KNOWLEDGEABLE – Now, you know your scores – do your research! At least learn the basics of credit and the FCRA (Fair Credit Reporting Act).

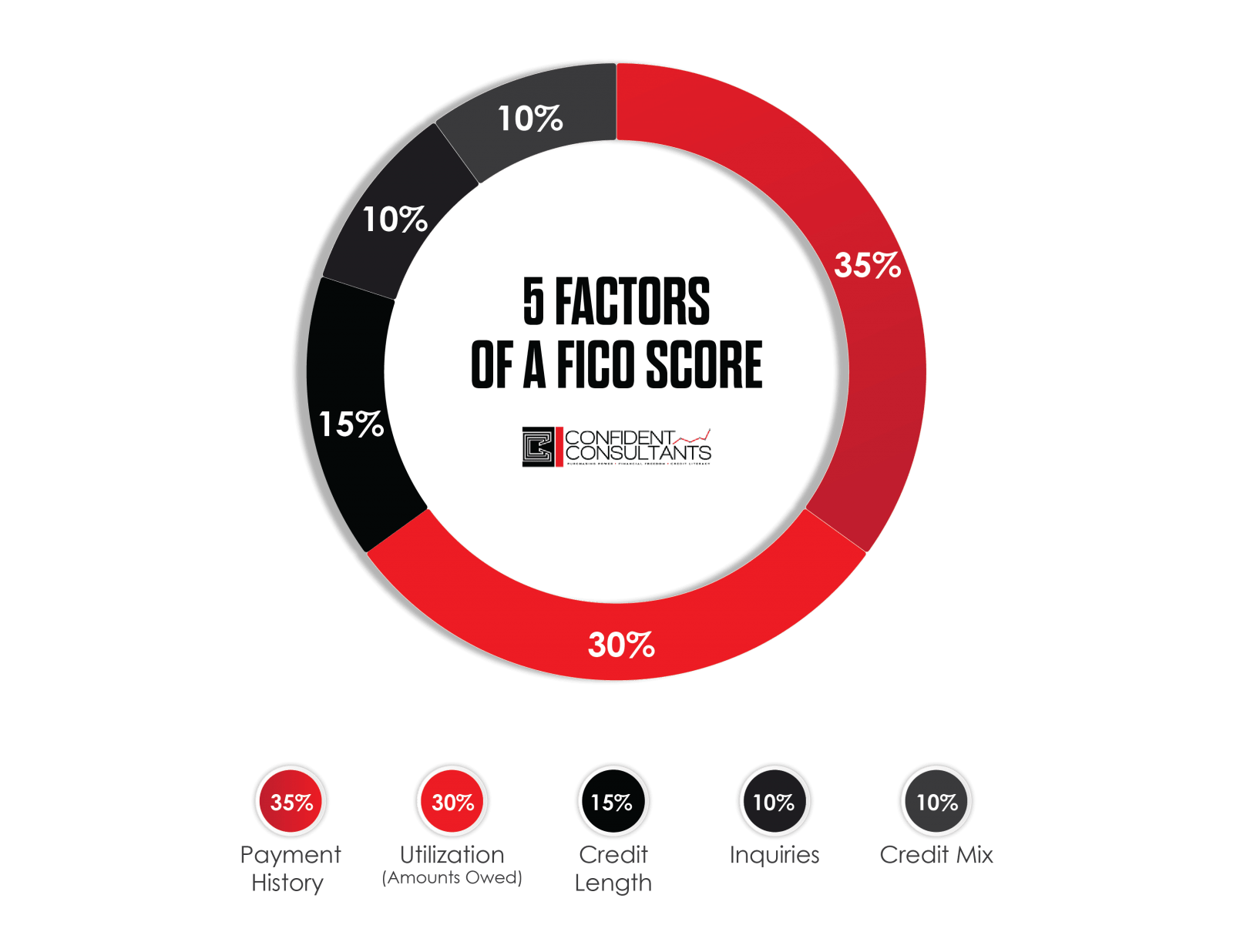

- CREATE A PLAN – Develop a strategic plan to execute the steps it will take to remove the negative challenges from your credit reports. After knowing your score and doing your research – you should know that payment history is the biggest component that factors into your FICO score. Then there’s amounts owed (debt), credit length (the more aged the better) and new credit. You MUST create a PLAN to execute – responsibly.

- CHECK YOUR PROGRESS – Make note of any and all changes to your credit reports. Learn what tactics work best and which ones are not. Even though Credit Karma does not offer FICO scores – it’s a great tracking tool to monitor deletions, new accounts, etc. PLUS it’s FREE! But, Identity IQ is an awesome way to monitor and track your FICO scores!

- CREATE A PLAN – Develop a strategic plan to execute the steps it will take to remove the negative challenges from your credit reports. After knowing your score and doing your research – you should know that payment history is the biggest component that factors into your FICO score. Then there’s amounts owed (debt), credit length (the more aged the better) and new credit. You MUST create a PLAN to execute – responsibly.

- CHECK YOUR PROGRESS – Make note of any and all changes to your credit reports. Learn what tactics work best and which ones are not. Even though Credit Karma does not offer FICO scores – it’s a great tracking tool to monitor deletions, new accounts, etc. PLUS it’s FREE! But, Identity IQ is an awesome way to monitor and track your FICO scores!

TIPS TO IMPROVE YOUR FICO SCORES

- Again, ALWAYS know your credit score and check it thoroughly for any and all errors. If you notice any errors on your credit report – promptly dispute them with the credit bureaus.

- Setting your payments to your creditors on auto pay will by far save you the hassle of remembering the exact due dates for all of your bills each and every month. Even, payment reminders are awesome! Regardless if it’s through your online banking with the institution of your choice, an email, text message or even an alert from your cellular phones calendar – have a reminder – life happens and sometimes we can forget!

- ALWAYS attempt to pay at LEAST the minimum amount due on all revolving credit accounts – preferably, paying more than the minimum due will assist in limiting excess interest.

- Reduce your debt! Of course, reducing debt is something easier said than done! But, with a plan and a budget – you can do it. The most effective way for me was to stop using credit cards totally – if I didn’t have the cash to cover it…I didn’t charge it! Do this only until you can decrease the utilization of the credit cards to at least BELOW 30%. Use your credit report to assist you in making a list of all your creditors, check your statements to see how much you owe each one + make note of the interest rates.

MORE TIPS ON HOW TO MAINTAIN CONFIDENT CREDIT

Payment History Tips ~ 35% of FICO Scores calculation

- Pay your bills on time

- If you have previous late payments – alter your habits- get current and remain current

- DO NOT PAY OFF COLLECTION ACCOUNTS – this will NOT remove the account from your credit reports – in fact it will remain on your credit report seven (7) years from the date of the last activity!

- Life happens – if you are in a hole and you foresee yourself falling behind on payments – CONTACT your creditors and ask for an arrangement – feel free to contact our Credit Restoration Consultants for further assistance

Amounts Owed Tips ~ 30% of FICO Scores calculation

- Keep all of your “revolving credit” accounts – as well as credit cards low

- Don’t move around debt – pay it off

- Do NOT close unused credit cards as a short term strategy to raise your FICO Scores – it will not work

- Do NOT open numerous new credit cards that will not benefit you nor your credit rating

Length of Credit History Tips ~ 15% of FICO Scores calculation

- If you have only been maintaining credit for a short period of time – do not open a lot of new accounts too fast. New accounts will lower your average account age – which will have a much larger effect on your scores if you do not have a lot of information reporting already. It can also look a little desperate and risky to potential creditors.

New Credit Tips ~ 10% of FICO Scores calculation

- Re-establish your credit history if you’ve had issues in the past. By responsibly opening new accounts and paying them off on time will raise your scores in the long run

- It’s okay to request and check your own credit reports. This will NOT affect your credit score, as long as you order your credit reports directly from the credit reporting agency OR via an organization authorized to provide credit reports to consumers

- Rate shop for a potential loan within a focused period of time. FICO Scores distinguish between a search for a single loan and a search for many new credit lines, in part by the length of time over which inquiries occur

Types of Credit Use Tips ~ 10% of FICO Scores calculation

- ONLY apply for and open new credit accounts as needed or recommended from your Confident Consultant. Do not open accounts simply to only have a better mixture – especially if you can not afford to maintain them

- Be RESPONSIBLE with managing your credit cards. Credit cards and installment loans will build your credit scores – when paying on time. Those with NO credit cards tend to be a higher risk that someone who has managed credit cards responsibly

- Closing an account does NOT make it go away. It will still appear on your credit reports and may factor into your score

Resources

annualcreditreport.com ~ FREE credit reports annually!

Budget Tips

IMPORTANT FACTS

- Make a Budget every month.

- Pay down debt using the Debt Snowball method (from smallest to largest debt)!

- Carry these type of insurances:

✓ Health Insurance

✓ Homeowners Insurance

✓ Auto Insurance

✓ Term Life Insurance

✓ Long Term Disability

✓ ID Theft

LEARN HOW TO SAVE & BUDGET MONEY~

- Pay yourself First! – On payday, set up automatic draft as a monthly bill. Out of sight out of mind.

- A BUDGET is simply: (Take home income) – (expenses) – (debt) =$ left over

- Tell your COINS where to go, or else they will Leave!! A budget assigns every dollar a name!

- Once you learn how to successfully budget, it will feel like you got a RAISE!